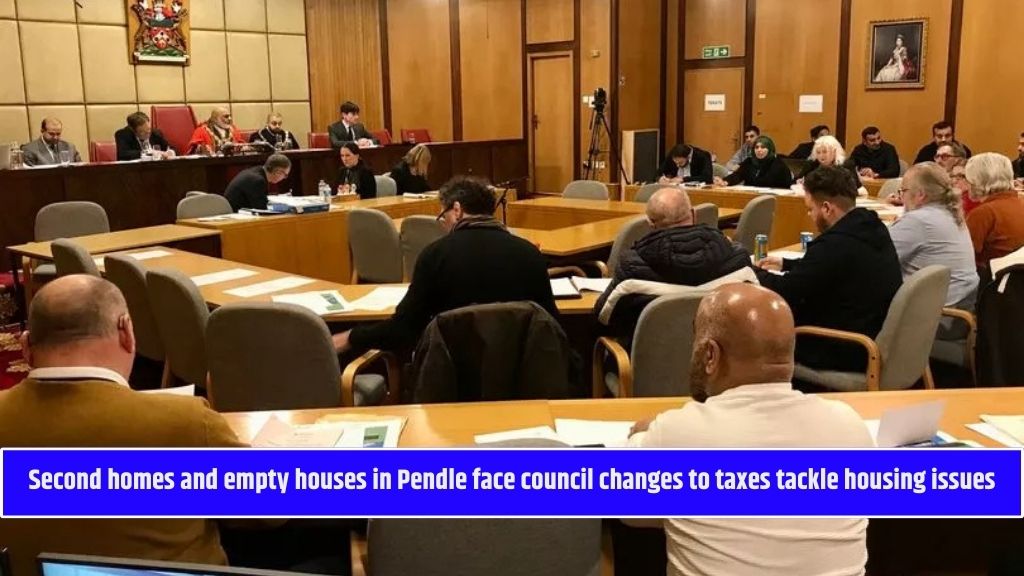

The owners of empty homes and second properties in Pendle could soon face higher council tax charges. In an effort to encourage better use of housing, reduce long-term vacancies, and support local services, Pendle Council is considering changes that will take effect this year for empty homes and in 2026 for second homes.

Why is Pendle Council Changing Council Tax Rules?

Under the Levelling-Up Act 2023, local councils have been given the power to increase council tax on properties that remain unoccupied for long periods. Pendle Council aims to implement these changes to:

- Encourage property owners to use or rent out empty homes

- Reduce the number of long-term vacant houses

- Generate additional revenue for essential public services like policing and fire departments

Current Situation in Pendle

A recent council report highlights the following housing statistics in Pendle:

- 304 properties have been empty for over a year

- 252 properties are classified as second homes

These figures have raised concerns among councillors, especially in urban and rural areas like Colne and Nelson.

Changes to Council Tax for Empty Homes

One of the key changes being discussed is reducing the minimum period for council tax premiums on empty homes:

- Currently, a 100% council tax premium applies after two years of vacancy.

- The proposal would reduce this to just one year, meaning higher charges would apply sooner.

- Higher premiums of 200% and 300% would be introduced for properties that remain empty for five and ten years, respectively.

If implemented, this change will begin in April 2024 and is expected to generate £522,000 in revenue, with £68,000 retained by Pendle Council.

A dwelling is considered vacant if it is not the main residence of an individual and is substantially unfurnished.

Council Tax Changes for Second Homes

The new tax rule for second homes is set to come into effect in April 2026.

- Second homes are defined as properties that are not a person’s primary residence but are furnished.

- The council plans to apply a 100% council tax premium, effectively doubling the tax for these properties.

- This change is estimated to generate £450,000 annually, with £58,000 going to Pendle Council.

- Property owners must be given 12 months’ notice before this tax is enforced.

Who is Exempt from the Higher Tax?

Some properties will be exempt from these council tax increases, including:

- Homes in probate (legal process after the owner’s death)

- Properties actively being sold or rented

- Houses undergoing major repairs

- Job-related homes, including caravan pitches and boat moorings

- Seasonal homes in managed holiday parks

Additionally, Pendle Council has provisions for reductions and hardship relief for individuals struggling to pay council tax.

Council’s Discretion on Tax Implementation

The council has the discretion to decide whether to implement these changes and at what rate, within the limits of the Levelling-Up Act. Discussions on these new policies will take place in upcoming budget meetings.

Pendle Council’s proposed changes to council tax aim to tackle housing shortages, encourage property use, and boost funding for public services. While empty homes will face increased tax penalties starting in April 2024, second-home owners will have until April 2026 before the new charges apply. These measures reflect the council’s efforts to address long-term property vacancies while ensuring fairness for residents.

| Visit for More News and Updates | WSOA NEWS |